irs unveils federal income tax brackets for 2022

No More Guessing On Your Tax Refund. 7 rows 2022 Individual Income Tax Brackets.

Irs Announces 2022 Tax Rates Standard Deduction Amounts And More

The top marginal income tax rate of 37 percent will hit taxpayers with taxable income above 539900 for single filers and above 647850 for married couples filing jointly.

. Estimate Your Tax Bracket W Our Tool Today. That maximum exemption begins to phase out when taxpayer income reaches 539900. The difference is due to inflation during the 12-month period from September 2019 to August 2020 which is used to figure the adjustments.

There are seven federal tax brackets for the 2021 tax year. For 2020 the federal mileage rate is 0575 cents per mile. That means a married couple will need to earn almost 20000 more next.

Irs Unveils Federal Income Tax Brackets For 2022 Syracuse. And is based on the tax brackets of 2021 and 2022. The IRS sets a standard mileage reimbursement rate.

Nora Carol Photography Getty Images The IRS has announced federal income tax brackets for 2022. The IRS also announced that the standard deduction for 2022 was increased to the following. And the standard deduction is increasing to 25900 for married couples filing together and 12950 for.

However the IRS has increased the income limits to adjust for the highest annual rise in inflation since 1990. 12950 Heads of households. 10 12 22 24 32 35 and 37.

In 2022 the income limits for all tax brackets and all filers will be adjusted for inflation and will be as follows Table 1. Irs unveils federal income tax brackets for 2022. 10 12 22 24 32 35 and 37.

The federal tax brackets are broken down into. Discover Helpful Information and Resources on Taxes From AARP. Although the tax rates didnt change the income tax brackets for 2021 are slightly wider than for 2020.

Tax Alert To All Employers Effective January 1 2021. Thursday March 10 2022. The personal exemption for tax year 2022 remains at 0 as it was for.

2021 tax brackets irs calculatorthe new 2018 tax brackets are 10 12 22 24 32 35 and 37. Did withholding tables Change 2021. 20 with AGI up to 43000 in 2021 and 44000 in 2022.

Reimbursements based on the federal mileage rate arent considered income making. 2022 Standard Deduction and Personal Exemption. The single taxpayer exemption for tax year 2022 increased to 75900.

Be Prepared When You Start Filing With TurboTax. For 2022 theyre still set at 10 12 22 24 32 35 and 37. Ad Compare Your 2022 Tax Bracket vs.

19400 for tax year 2022. These are the rates and income brackets for federal taxes. See the latest tables below.

For turbotax live full service your tax expert will amend your 2021 tax return for you through 11302022. Your bracket depends on your taxable income. The standard deduction increased over 3.

35 for incomes over 209425 418850 for married couples filing jointly. 2020 federal income tax brackets for taxes due in may 2021 or in october 2021. The bill allows passthrough entities to retroactively elect to pay.

The seven tax rates themselves are unchanged but income limits for each bracket have been adjusted for inflation according to CNBC. This payment will come as a separate check. 35 for incomes over 215950 431900 for married couples filing jointly 32 for incomes over 170050 340100 for married couples filing jointly 24 for incomes over.

Ad Plan Ahead For This Years Tax Return. The standard deduction for married couples filing jointly for tax year 2022 rises to 25900 up 800 from the prior year. Single or married filing separately.

The irs isnt changing the percentages people will pay 10 for incomes of 10275 or less 20550 for married couples filing jointly 14650 for heads of household. Your 2021 Tax Bracket to See Whats Been Adjusted. 10 with AGI up to 66000 in 2021 and 68000 in 2022.

If youre owed a refund and the IRS still hasnt paid you 45 days past the tax-filing deadline the agency will owe you interest. Irs unveils federal income tax brackets for 2022 syracuse. The Kiddie Tax thresholds are increased to 1150 and 2300.

The tax items for tax year 2022 of greatest interest to most taxpayers include the following dollar amounts. Alternative Minimum Tax AMT Increase. Final 2022 tax brackets have now been published by the IRS and as expected and projected federal tax brackets have expanded while federal tax rates stayed the same.

The 2022 tax brackets affect taxes that will be filed in 2023 CNBC said. The IRS said the income thresholds for federal tax brackets will be higher in 2022 reflecting the faster pace of inflation. The IRS has announced federal income tax brackets for 2022.

Heads of households can claim a credit for up to 2000 of contributions at a rate. Married couples filing jointly. The IRS has announced higher federal income tax brackets for 2022 amid rising inflation.

10 percent 12 percent 22 percent 24. Importantly the 2021 brackets are for income earned in 2021 which most people will file taxes on before april 15 2022. 8 rows There are seven federal income tax rates in 2022.

Irs Tax Brackets 2022 What Do You Need To Know About Tax Brackets And Standard Deduction To Change In 2022 Marca. Once the 45-day. Jared Polis D has approved legislation making the states elective workaround to the federal cap on the state and local tax deduction retroactive to tax year 2018.

The new tax brackets for 2022 have been announced by the internal revenue service irs. The maximum Earned Income Tax Credit is 560 for no children. Jan 18 2022 The rate is increased for each dependent child and also if the surviving spouse is housebound or in need of aid and attendance.

Tax brackets for income earned in 2022 37 for incomes over 539900 647850 for married couples filing jointly 35 for incomes. The exemption for married couples filing jointly is 118100 and begins to phase out at 1079800. The tax brackets for 2022 have not changed in comparison to the previous year and taxable income is still divided into seven federal tax brackets as of 2021.

The refundable portion of the Child Tax Credit has increased to 1500. 25900 Single taxpayers and married individuals filing separately. Colorado Enacts Retroactive SALT Cap Workaround Bill - Benjamin Valdez Tax Notes.

Irs Announces 2022 Tax Rates Standard Deduction Amounts And More

Irs Announces 2022 Tax Rates Standard Deduction Amounts And More

Irs Releases Updated Withholding Calculator And New Form W 4 Tax Pro Center Intuit

Tax Refund 2022 What To Consider Before Filing Taxes So You Can Get More Back Abc7 New York

Federal Income Tax Is Already Very Progressive National Review

There S A Growing Interest In Wealth Taxes On The Super Rich

There S A Growing Interest In Wealth Taxes On The Super Rich

Blog Heintzelman Accounting Services

How To Do Your Taxes In 2022 Cbs News

Federal Income Tax Rates And Brackets And How Much You Ll Pay In 2022 Explained

Irs Announces 2022 Tax Rates Standard Deduction Amounts And More

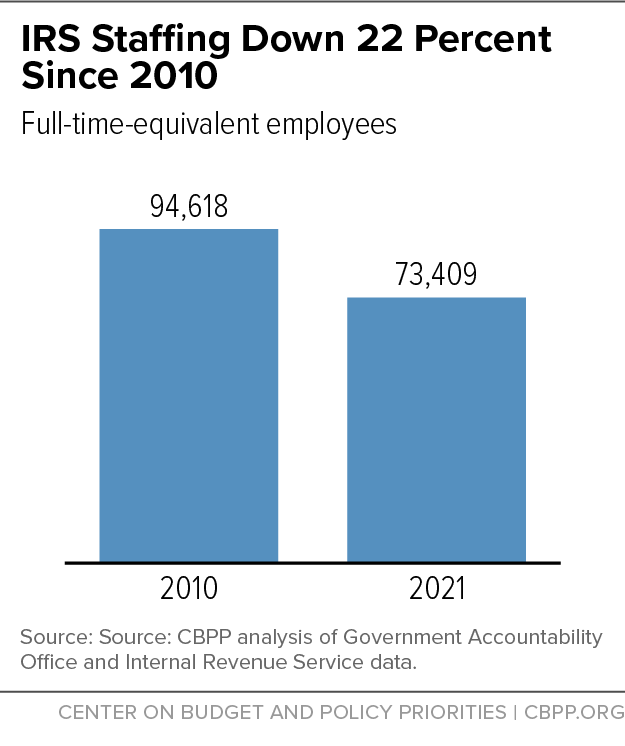

Congress Needs To Take Two Steps To Fund The Irs For The Short And Long Term Center On Budget And Policy Priorities

Irs Announces 2022 Tax Rates Standard Deduction Amounts And More

The Irs Has Sent Nearly 30 Million Refunds Here S The Average Payment

2020 Year End Tax Planning For Individuals

If Your Life Changed In 2021 Watch For Income Tax Surprises Wbur News

Irs Announces 2022 Tax Rates Standard Deduction Amounts And More

Another Democrat Tcja Talking Point Debunked Ways And Means Republicans

Congress Needs To Take Two Steps To Fund The Irs For The Short And Long Term Center On Budget And Policy Priorities